Case Study: The $5 Offer That Increased Pipeline Volume (and What the Data Really Said)

The Client’s Question

A growing service-based company introduced a $5 introductory offer as a low-friction entry point for new customers. It worked quickly: interest increased, deal volume climbed, and more prospects entered the pipeline.

But within a few quarters, leadership started noticing some worrying trends:

Conversion rates were dropping

Deals seemed to stall more often

Pipeline felt slower and less predictable

Sales reps were spending more time managing “open” deals

And the big question:

“Is the $5 offer hurting our sales performance?”

They asked us to analyze whether the $5 offer was the primary driver behind the observed decline in conversion efficiency and pipeline velocity.

The Hypothesis

The internal hypothesis was clear and logical:

The $5 offer is a primary driver of declining conversion efficiency and pipeline velocity.

More specifically, the concern was that the $5 offer:

Lowers perceived commitment at the point of entry

Reduces urgency to progress through onboarding and decision stages

Encourages evaluation behavior rather than purchase behavior

Increases the likelihood of deals stalling rather than closing

In other words: more leads, but worse sales performance.

The Approach: What We Analyzed in HubSpot

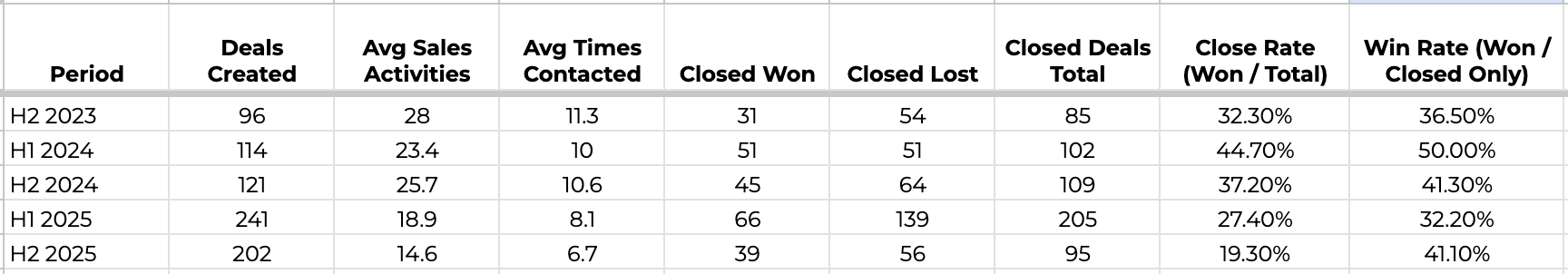

We performed a multi-period analysis using HubSpot CRM data. Instead of only looking at “before vs after,” we broke performance into half-year periods to see how patterns changed over time.

We analyzed:

Sales Performance

Deals created

Closed won / closed lost

Close rate (won / total)

Win rate (won / closed deals only)

Pipeline Velocity

Average time to close (closed deals only)

Sales Activity & Coverage

Average sales activities per deal

Average “times contacted” per deal

Source Mix

Original traffic source trends (Direct, Organic, Paid Search, Offline, Unknown)

Win rates by source

Deal value by source

Important note on $5 offer attribution

We were able to identify the first $5 quote date, which established the earliest point where the offer was in use. However, we could not reliably flag every deal as “$5 offer used” vs “not used” because the offer wasn’t consistently tracked via a dedicated deal property.

That meant our analysis focused on trend-based impact, not strict $5 vs non-$5 segmentation.

What We Found (The Short Version)

1) Deal Volume Increased Dramatically

Pipeline volume expanded significantly over time. In the most recent year, deal creation volume was materially higher than prior periods.

This supported one part of the hypothesis:

✅ The offer (and related marketing motion) likely increased top-of-funnel activity.

2) Conversion Efficiency Declined — But Not Immediately After the Offer

Conversion efficiency declined later, not right away.

In fact, the period immediately following the offer rollout was not a collapse—it was one of the stronger windows.

This was a key moment in the analysis because it challenged the assumption that:

“The offer itself must be the main cause of declining conversion.”

Instead, it suggested something more nuanced:

⚠️ The offer may influence behavior, but performance depends heavily on how the pipeline is worked.

3) Sales Follow-Up Coverage Per Deal Dropped Sharply

One of the most consistent and telling trends was this:

Sales activity per deal decreased significantly over time.

When deal volume doubled, the average number of sales activities and contact attempts per deal dropped by nearly half.

That’s a classic capacity signal.

When the funnel expands faster than the team’s ability to work it, you typically see:

more deals entering “Not Now” or stalling stages

more open pipeline carryover

lower conversion efficiency

fewer closed outcomes per period

This supported a different root cause:

✅ Follow-up coverage per deal is a major driver of conversion performance.

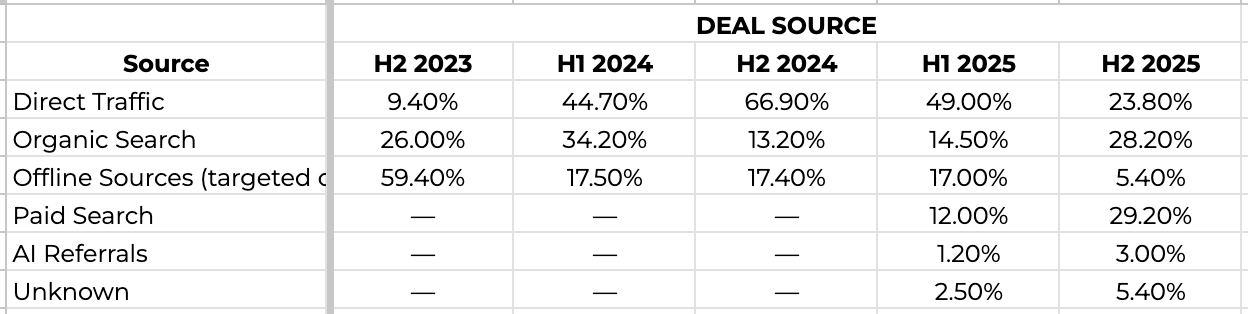

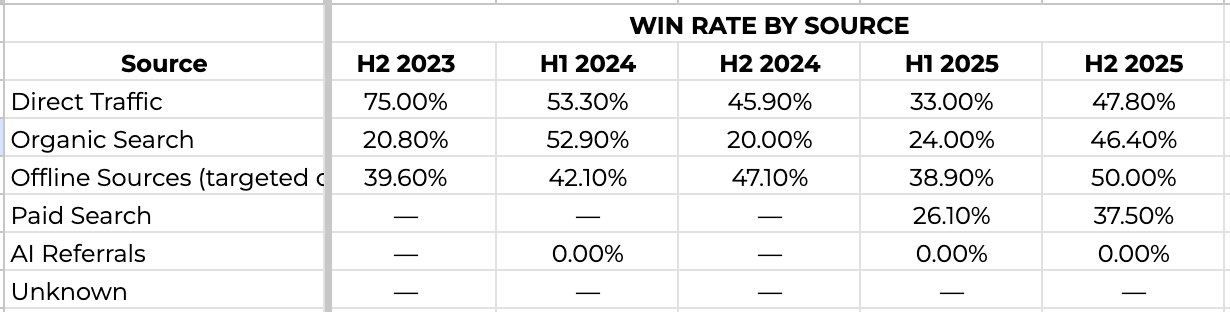

4) Source Mix Shifted — Especially in Paid Search

We also found that the lead acquisition mix changed significantly over time.

The biggest shift was the growth of Paid Search, which became a major source of created opportunities in later periods.

Paid Search typically introduces:

more evaluators

more comparison shopping

lower urgency at entry

higher need for follow-up to convert

At the same time, “Offline Sources” (which, in this case, represented targeted outbound segments) became a smaller portion of the total mix.

This matters because source mix impacts conversion math even when sales execution stays constant.

If you add more evaluation-stage buyers into the pipeline, you can expect:

higher volume

lower conversion rate

longer decision cycles

The Key Conclusion

The data did not support the conclusion that the $5 offer was the primary driver of declining sales performance.

Instead, we found something more actionable:

The $5 offer increases top-of-funnel activity and evaluation behavior, but conversion efficiency only declines when sales activity per deal drops.

The most likely drivers of the decline were:

Lead volume scaling faster than sales capacity

Reduced follow-up coverage per deal

Source mix shift toward Paid Search + Unknown attribution

More deals staying open longer and accumulating in the pipeline

This is a critical distinction because it changes the business decision from:

❌ “We should kill the offer.”

to

✅ “We should fix the conversion motion around the offer.”

What We Recommended (and Why It Works)

1) Treat the $5 offer as a “trial conversion,” not a purchase

Low-cost offers reduce friction—but they also reduce urgency. The solution is to build a conversion motion that drives momentum:

time-box the $5 trial period

create onboarding milestones

define the “upgrade moment”

trigger follow-ups automatically

2) Protect follow-up coverage per deal

When volume increases, sales execution must scale with it. We recommended:

minimum follow-up cadence by stage

automated task creation

SLA-style response expectations

pipeline hygiene rules for stale deals

3) Segment by source and tailor qualification

Not all sources behave the same. Paid Search leads may need:

faster qualification gates

clearer next steps

different messaging

a tighter timeline to decision

4) Improve tracking for future clarity

The team already had a CRM property designed to track $5-offer progression (Accepted, Signed, Missed Payment), but it wasn’t being used consistently.

We recommended standardizing this so future reporting can answer the real question:

Do $5-offer deals convert better, worse, or simply differently than non-$5 deals?

Final Takeaway

Low-friction offers can be powerful growth levers—but they change buyer behavior.

The real risk isn’t the offer itself. It’s what happens when:

the pipeline expands

lead intent shifts

and sales follow-up coverage per deal drops

When that happens, conversion efficiency declines and pipeline velocity slows—even if the offer is still doing its job at the top of the funnel.

Want to Run This Analysis in Your HubSpot Portal?

If your team is asking questions like:

“Why is pipeline growing but revenue isn’t?”

“Are we closing fewer deals or just moving slower?”

“Did our lead mix change?”

“Is our offer helping or hurting conversion?”

We can help you build a repeatable reporting model to answer those questions—using the data you already have.